Samyama Advisors provides exclusive investment advisory services through a web and mobile based platform known as Edufund (owned by the parent company of Samyama Advisors). We believe that the biggest risk for parents is that they are unaware of the actual costs of education till the last moment. Education inflation is growing at a higher rate than household inflation. Also, there is excessive dependence on loans, scholarships, and illiquid assets (e.g.- real estate) that are not easy to sell and have uncertain returns. Education is an aspirational event in a child’s life and needs planning to achieve dreams.

Objective behind creating EduFund –

· Unique planning platform that aligns your education journey to your personal finances

· A platform with a holistic approach to one’s education journey vs an event-based approach followed today.

· Helping Indian parents to simplify their financial burden of giving their child a global education.

Investment Philosphy

With thousands of mutual fund schemes available in the market identifying the best funds to invest in is a very difficult task. Moreover, with a tendency amongst investors to fall for the ‘Rs 10’ investment proposition – offered by New Fund Offerings (NFOs), the task of picking the right one is daunting. Many investors feel that ‘any’ mutual fund can help them achieve their desired goals. But there needs to be awareness that each mutual fund scheme is unique and caters to a certain risk-reward profile.

Investment Process

Selecting top mutual funds remains a key priority for investors and involves a rigorous process, where both quantitative and qualitative parameters are considered. It is imperative to have consistent performers in a portfolio particularly those that can support you in emergency situations.

Following parameters are identified based on which a fund can be selected that can potentially perform well:

Long-term performance should be looked at over recent performance as that can help us in evaluating the consistency of performance. For instance, a fund that has very differing performances in just 2 years is not a great idea – generating 50% absolute returns in one year and losing 40% the following year is not a great fund to pick. Thus, we look at the consistency of performance as one of the key parameters. In addition, understanding a fund’s historical performance during market growth and market fall, measured by Upside and Downside Capture Ratios gives a holistic picture of what one could expect during the lifetime of a fund.

Also, while the past performance of a mutual fund scheme is important, it is not the only parameter to consider as past performance may or may not be sustained, in future. Thus, we evaluate the risk factors in great detail. We can use risk and return parameters such as standard deviation, alpha, Sharpe ratio etc. to evaluate a fund.

On the cost front, an investor should take into account the expense ratio to ensure that a sizable asset doesn’t go towards fund expenses such as brokerage, distribution, commission, etc.

Additionally, critically examine the team managing the fund, as the experience of the fund manager and his/her team is an important factor to ensure hard-earned money goes into competent hands.

Lastly, the lesser the Assets Under Management (AUM) the riskier the scheme is. This is because we are not aware of who the investors are and what is the quantum of investment made by these investors in the scheme. Usually investors exiting mutual funds affects overall performance of the fund negatively, preference should be given to schemes with larger AUMs, so that this risk is minimized.

Risk Assesment Process

We believe that the most fundamental risk is not being fully aware about the risk of each fund that is recommended. Our team, manages this risk through in-depth fundamental research. Our research process includes a thorough analysis of all the funds including the study of past performance, up market capture, down market capture etc. Disciplined portfolio construction is vital for managing risk of a portfolio.

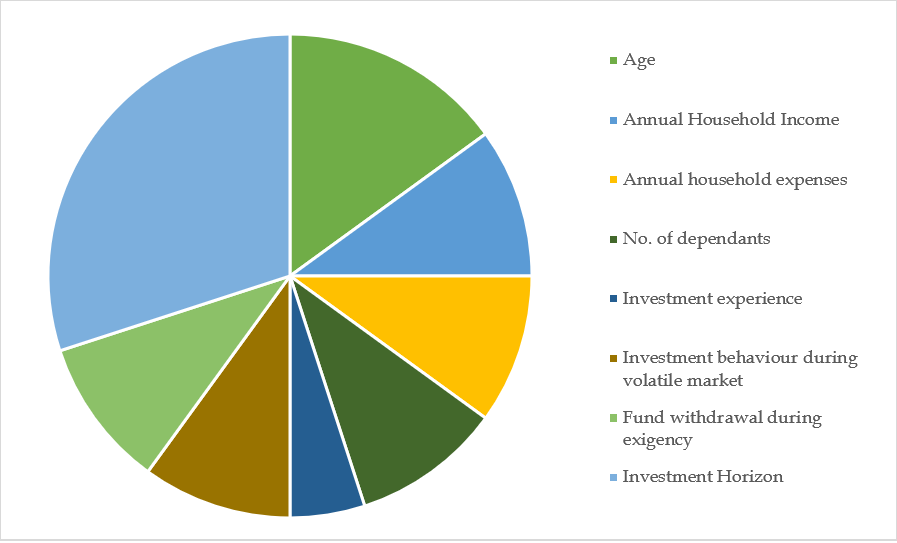

Samyama Advisors’s proprietary risk assessment framework –

· Date of Birth (Age) – Age plays a vital role in determining risk appetite. At a younger age one has the capacity and willingness to take higher risk because he/she is in the accumulation or earning stage of lifecycle where there is a runway before retirement.

· Annual Household Income – If the income is good, an individual won’t hesitate to invest in various schemes because a little financial set back may not affect financial situation considerably.

· Annual Household Liabilities & Expenses – If income is high and the expenses are higher, the savings percentage could be little. This results in doubts and fears related to taking risk.

· No. of Dependents – Fulfilling the needs and wants of all the members could be challenging and brings in responsibility. If there are more members dependent on the same person then there is not much scope to take risk.

· Your investment experience so far can be described as? – Having knowledge related to schemes and investments increase awareness and thus adds to your risk appetite.

· What would you do if the markets dip and your portfolio is down by 25%? – It is impossible to predict the market. Often investors panic and sell when markets fall (example, Demonetization in Nov 2016). What is important is to understand how a person behaves when markets correct and this helps in understanding the risk-taking ability.

· How much funds from your portfolio (investments) would you withdraw to meet any exigency? – Emergency may arise anytime. If a person has not planned for emergency and is withdrawing money from any objective based corpus, his risk appetite is low.

· Length of investment horizon – The length of an investment horizon determines how much risk an investor is exposed to and what their income needs are. When portfolios have a shorter investment horizon that means investors are willing to take on less risk. For example, an investor with a horizon of 20 years would typically have most of their assets allocated to equities and may be mid-cap and small-cap stocks where these sub-asset classes tend to exhibit much larger price swings over short time periods than do large-cap stocks.